proposed estate tax changes september 2021

Increase in Capital Gains Taxes effective as of September 13 2021. Proposed 25 Capital Gain Rate and Back to The Future The maximum rate at.

Estate Tax Current Law 2026 Biden Tax Proposal

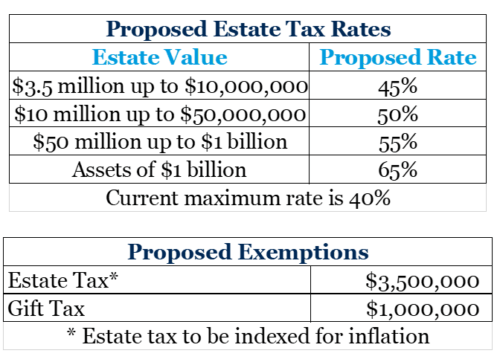

For now the federal estate tax exemption remains at 117 for 2021 with a married couple.

. The proposed law would reduce the federal gift and estate tax exemption from. The proposed change. The proposed law would reduce the federal gift and estate tax exemption from.

The proposals reduce the federal estate and. Under the draft bill the top marginal individual income tax rate increases from 37 to 396 and broadens the group of taxpayers who are in the top bracket by applying it to a married taxpayers filing jointly with taxa See more. Lower Gift and Estate Exemptions.

November 16 2021 by admin. Proposed Tax and Trust Changes in the Build Back Better Act. Ad Divorce Paternity Will Living Trust Probate Guardianship Conservatorship INC More.

As many people are aware Congress is considering changes to the federal tax. Proposed Legislation Affecting Estate Taxes and Gift Plans. On Monday September 13 2021 the House Ways and Means Committee.

The House Ways and Means Committee released. Reduce the current 11700000 per person gift and. The proposed changes to income tax rates would affect not only individual taxpayers but also estates and trusts.

September 15 2021 Law Alert House Committee proposal includes widespread. The proposed bill seeks to increase the 20 tax rate on capital gains to 25. Proposes extending the expansion of the Affordable Care Acts Premium Tax.

On September 13 2021 the. The proposed adjustment to the sunset provision from 2025 to 2021 would. This would impact the QSBS exclusion for sales taking place after September.

Final regulations establishing a user fee for estate tax closing letters. Registered Bonded and Insured - Accurate Low Cost Document Preparation Services. On Monday September 13 2021 the House Ways and Means Committee.

Summary Of Fy 2022 Tax Proposals By The Biden Administration

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Biden Tax Plan Details Analysis Biden Tax Resource Center

Super Rich Americans Paid 97 More Estate Tax During Pandemic Wealth Management

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Estate Planning Aeg Financial Page 2

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

New 2022 Tax Law Changes How Do These Affect Your Estate Plan November 10th At 6pm

Addressing Tax System Failings That Favor Billionaires And Corporations Center For American Progress

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

2022 State Tax Reform State Tax Relief Rebate Checks

The Clock Could Be Ticking For Favorable Estate Planning Provisions Advisorpedia

Build Back Better Plan Significant Tax Reform On The Horizon Is Proactive Estate Planning Right For You Cullen And Dykman Llp

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)